Archive

Another look at employment and market share

A very thoughtful comment was made about HBJ post Employment: Multidisiplinary firms vs. heritage-only firms (18 Feb 2012):

“Large multi-service firms tend hire and terminate for each project because their offices rarely have enough local work to retain technicians. They tend to have centralized full time labs and production centers that do not have positions for techs for after fieldwork tasks. Whereas many hertiage-only company like CRA use full-time technicians in a variety of tasks. The ability to live near a company’s office(s) to come in and do post-fieldwork tasks is the key to full time work. In addition the ability to move techs and other staff between offices reduce the need for temporary project specific techs except for the largest field projects. Plus in any given year we receive enough cold call applicants from technicians with good resumes that simply working the resume file drawer eliminates the need for an ad for most projects.”Steve Creasman and Kay Simpson

A high turnover of technicians in multi-service firms could easily explain why there are more job advertisements from these types of companies than from heritage-only firms. To explore this more, I also took a look at senior positions (e.g. principle investigators, senior archaeologists, office/regional managers) for the same 2011 data set. Of course titles are not standardized across the sector and names can be misleading, but a full 46% of the job advertisements reviewed asked for 10-25 years of experience and 55% asked for 5-9 years of experience (a slight overlap with some asking for 8-12 years). The job descriptions and requirements (years of experience, permits, etc.) firmly place these jobs in the top levels of employment regardless of title. None of these jobs mentioned temporary employment but that does not mean it is not. However, asking for 20 years of experience for a temporary job would be rare but not unheard of (or it should be in my personal opinion). Out of 79 job postings, 61 of them mentioned their employers (some of the job postings have been removed making it impossible to see who was the employer).  In this data set the breakdown is even more lopsided in favor of multi-service firms

In this data set the breakdown is even more lopsided in favor of multi-service firms

Heritage-only firms may look for their top-level workers through other means than advertisement such as internal promotion or through professional networks. A lack of lower level positions in multi-service firms may make it hard for them to recruit internally. What these data do show is that the majority of job advertisements for archaeologists at all career levels was dominated by multi-service firms in 2011. Does this mean they get the majority of business? That can not be determined from these numbers but employment may indicate strong growth prospects.

Driven by oil, central Canada compliance is forecast higher in 2012

In October of 2011, Charles Mount blogged about the correlation of construction output and archaeological licences in Ireland. The correlation was such that you could predict with some confidence, either licences or construction output, from the other. Clever, but what drives the Canadian CRM industry?

Unfortunately, as pointed out recently in HBJ by Christopher Dore (17 February 2012), there is no North American Industry Classification System (NAICS) code for CRM archaeology and there are no country wide statistics on archaeological activity in Canada. Hence begins the quest for drivers for the Canadian CRM industry.

Initial speculation was that price of oil was a significant driver in the archaeological economies of Alberta and Saskatchewan. Both provinces have growing and diverse economies, but the petroleum industry is an important component of the economy. There is no single price of oil, but the New York Mercantile Exchange (NYMEX) produced a nice online summary of the price of light, sweet crude. Saskatchewan has both light and heavy crude. For this analysis I looked at the maximum weekly price for the year, the minimum weekly price for the year, and the closing price during the last week of the year.

Next I looked at the number of archaeological permits issued by Alberta and Saskatchewan between 2008 and 2011. There are a few differences in the numbers and types of permits that both provinces issue, but these are not material to the analysis. Overall for this time period, there was a sharp decline in 2009 with a slow recovery in 2010 and 2011.

The number of permits appears to be well correlated with the maximum price of oil (permits and oil prices are normalized to a maximum value of 100). Permits also correlated with the minimum and December close, however for the latter two, the price of oil leads the number of permits by a year. So the minimum price of oil sharply declined in 2008, the year with the highest price, but the decline in permits took place in 2009.

Does this make sense? It does. There is a base price to drill and if the price of oil is too low, it is better to scale back production until prices rise. My prediction is that given the high December closing price, the number of archaeological permits will increase in 2012.

What about other provinces? I am collecting data but I am curious what others think are the prime economic drivers of their regions.

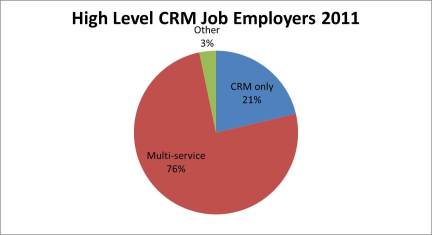

Employment: Multidisiplinary firms vs. heritage-only firms

In a recent HBJ post (17 February 2012), Christopher Dore reported that it appears that heritage-only consulting firms are losing market share to full-service firms. To add a different set of numbers to his data, I took a look at the number of job postings for field technicians on the job websites Shovelbums and ArchaeologyFieldwork.com for 2011. Eliminating duplicate posts both between and within the websites, I looked at companies offering jobs for field technicians: a total of 330 separate posts. Jobs were considered separate if the project was different even if the company was the same, six or more months had passed, or it was an emergency hire for a previous job (assumed to be a separate hiring event). If single ads were for multiple positions, the number of positions offered was not counted as most job postings did not give those details. Surprisingly, not every job listing had the company’s details or even the firm’s name on it. Thus, of the 330 unique postings, 295 were used for analysis. Here is the break down of job hiring events between CRM only firms, multi-service firms, and other firms.

In 2011, multi-service firms posted more than twice the number of job ads for field technicians than did cultural-only firms. These employment data seem to support Dore’s observation that heritage-only firms are losing market share to multidisciplinary environmental and engineering companies.

There are limits to what can and should be inferred by these results. There are many small CRM firms that do not advertise for field technician positions as their projects are too small to require a full crew. Though it does say something that the majority of job adverts for lower level positions are being done by multi-service firms. The full data can be accessed here.