Archive

New small business thresholds in North America will change competition

Last week in the Federal Register, the United States Small Business Administration increased 37 small business size standards for 34 industries in Sector 54, Professional, Technical, and Scientific Services. Under the North American Industry Classification System (NAICS), used by Canada, Mexico, and the United States, the industry code for Environmental Consulting Services (541620) was increased from $7 to $14 million. The majority of cultural resource consulting firms in North America are in the Environmental Consulting Services category. This change was effective yesterday, 12 March 2012.

Within the United States, many, perhaps the majority, of cultural resource compliance service contracts issued by the federal government are set aside for small businesses. This new, larger, small business size category will change the competitive landscape by allowing firms with annual revenue up to $14 million to compete directly with truly small firms for small business contracts. The American Cultural Resources Association (ACRA), the trade organization for the heritage compliance sector, classifies small firms as those with annual revenue below $400,000, medium firms as those with annual revenue between $400,000 and $1.5 million, and large firms as those having annual revenue above $1.5 million. This new ruling will not provide any protection for truly small heritage firms, those in ACRA’s small and medium categories, and create head-to-head market competition for all firms below the $14 million threshold. For companies who target the federal contracting sector, there is now an advantage to being larger and this may prompt a new round of heritage firm mergers and acquisitions in North America.

Another look at employment and market share

A very thoughtful comment was made about HBJ post Employment: Multidisiplinary firms vs. heritage-only firms (18 Feb 2012):

“Large multi-service firms tend hire and terminate for each project because their offices rarely have enough local work to retain technicians. They tend to have centralized full time labs and production centers that do not have positions for techs for after fieldwork tasks. Whereas many hertiage-only company like CRA use full-time technicians in a variety of tasks. The ability to live near a company’s office(s) to come in and do post-fieldwork tasks is the key to full time work. In addition the ability to move techs and other staff between offices reduce the need for temporary project specific techs except for the largest field projects. Plus in any given year we receive enough cold call applicants from technicians with good resumes that simply working the resume file drawer eliminates the need for an ad for most projects.”Steve Creasman and Kay Simpson

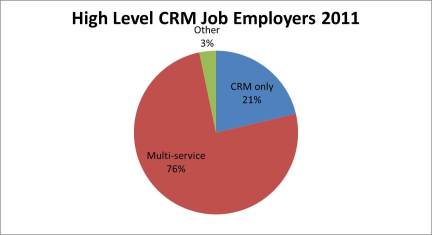

A high turnover of technicians in multi-service firms could easily explain why there are more job advertisements from these types of companies than from heritage-only firms. To explore this more, I also took a look at senior positions (e.g. principle investigators, senior archaeologists, office/regional managers) for the same 2011 data set. Of course titles are not standardized across the sector and names can be misleading, but a full 46% of the job advertisements reviewed asked for 10-25 years of experience and 55% asked for 5-9 years of experience (a slight overlap with some asking for 8-12 years). The job descriptions and requirements (years of experience, permits, etc.) firmly place these jobs in the top levels of employment regardless of title. None of these jobs mentioned temporary employment but that does not mean it is not. However, asking for 20 years of experience for a temporary job would be rare but not unheard of (or it should be in my personal opinion). Out of 79 job postings, 61 of them mentioned their employers (some of the job postings have been removed making it impossible to see who was the employer).  In this data set the breakdown is even more lopsided in favor of multi-service firms

In this data set the breakdown is even more lopsided in favor of multi-service firms

Heritage-only firms may look for their top-level workers through other means than advertisement such as internal promotion or through professional networks. A lack of lower level positions in multi-service firms may make it hard for them to recruit internally. What these data do show is that the majority of job advertisements for archaeologists at all career levels was dominated by multi-service firms in 2011. Does this mean they get the majority of business? That can not be determined from these numbers but employment may indicate strong growth prospects.

Driven by oil, central Canada compliance is forecast higher in 2012

In October of 2011, Charles Mount blogged about the correlation of construction output and archaeological licences in Ireland. The correlation was such that you could predict with some confidence, either licences or construction output, from the other. Clever, but what drives the Canadian CRM industry?

Unfortunately, as pointed out recently in HBJ by Christopher Dore (17 February 2012), there is no North American Industry Classification System (NAICS) code for CRM archaeology and there are no country wide statistics on archaeological activity in Canada. Hence begins the quest for drivers for the Canadian CRM industry.

Initial speculation was that price of oil was a significant driver in the archaeological economies of Alberta and Saskatchewan. Both provinces have growing and diverse economies, but the petroleum industry is an important component of the economy. There is no single price of oil, but the New York Mercantile Exchange (NYMEX) produced a nice online summary of the price of light, sweet crude. Saskatchewan has both light and heavy crude. For this analysis I looked at the maximum weekly price for the year, the minimum weekly price for the year, and the closing price during the last week of the year.

Next I looked at the number of archaeological permits issued by Alberta and Saskatchewan between 2008 and 2011. There are a few differences in the numbers and types of permits that both provinces issue, but these are not material to the analysis. Overall for this time period, there was a sharp decline in 2009 with a slow recovery in 2010 and 2011.

The number of permits appears to be well correlated with the maximum price of oil (permits and oil prices are normalized to a maximum value of 100). Permits also correlated with the minimum and December close, however for the latter two, the price of oil leads the number of permits by a year. So the minimum price of oil sharply declined in 2008, the year with the highest price, but the decline in permits took place in 2009.

Does this make sense? It does. There is a base price to drill and if the price of oil is too low, it is better to scale back production until prices rise. My prediction is that given the high December closing price, the number of archaeological permits will increase in 2012.

What about other provinces? I am collecting data but I am curious what others think are the prime economic drivers of their regions.